Governor Phil Murphy signs 7 new bills aimed at tightening gun laws in New Jersey

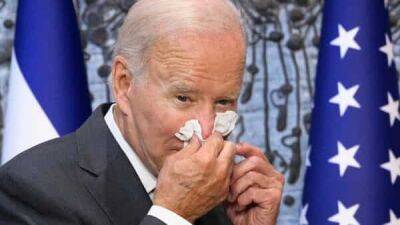

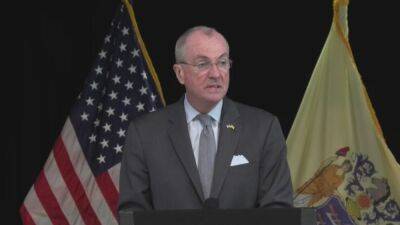

METUCHEN, N.J. - New Jersey Gov. Phil Murphy has signed seven new bills into law aimed at curtailing gun violence, including legislation to allow the state attorney general to pursue lawsuits against the firearm industry.

Murphy signed the bills Tuesday in the wake of a fatal Independence Day shooting in Illinois, as well as recent mass shootings in New York and Texas.One measure requires safety training to get a firearm purchasers permit, and another bans .50-caliber weapons.

Murphy signed the measures alongside advocates for tighter gun laws and other public officials. He says more still needs to be done after a Supreme Court ruling striking a requirement for permit holders to show a specific need to carry firearms..